Renters Insurance in and around San Antonio

Your renters insurance search is over, San Antonio

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- San Antonio

- Schertz

- Converse

- Cibolo

- Bexar County

- China Grove

- Alamo Heights

- Alamo Ranch

Home Is Where Your Heart Is

Trying to sift through providers and coverage options on top of keeping up with friends, your pickleball league and work, can be time consuming. But your belongings in your rented house may need the incredible coverage that State Farm provides. So when the unexpected happens, your mementos, linens and clothing have protection.

Your renters insurance search is over, San Antonio

Rent wisely with insurance from State Farm

State Farm Has Options For Your Renters Insurance Needs

You may be wondering: Is having renters insurance beneficial? Imagine for a minute what it would cost to replace your possessions, or even just a few high-cost things. With a State Farm renters policy backing you up, you won't waste time worrying about fires or break-ins. But that's not all renters insurance can do for you. It extends beyond your rental space, covering personal items you've left in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. With so much of your life accessible online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Aaron Furlong can help you add identity theft coverage with monitoring alerts and providing support.

If you're looking for a committed provider that can help with all your renters insurance needs, get in touch with State Farm agent Aaron Furlong today.

Have More Questions About Renters Insurance?

Call Aaron at (210) 337-1786 or visit our FAQ page.

Simple Insights®

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.

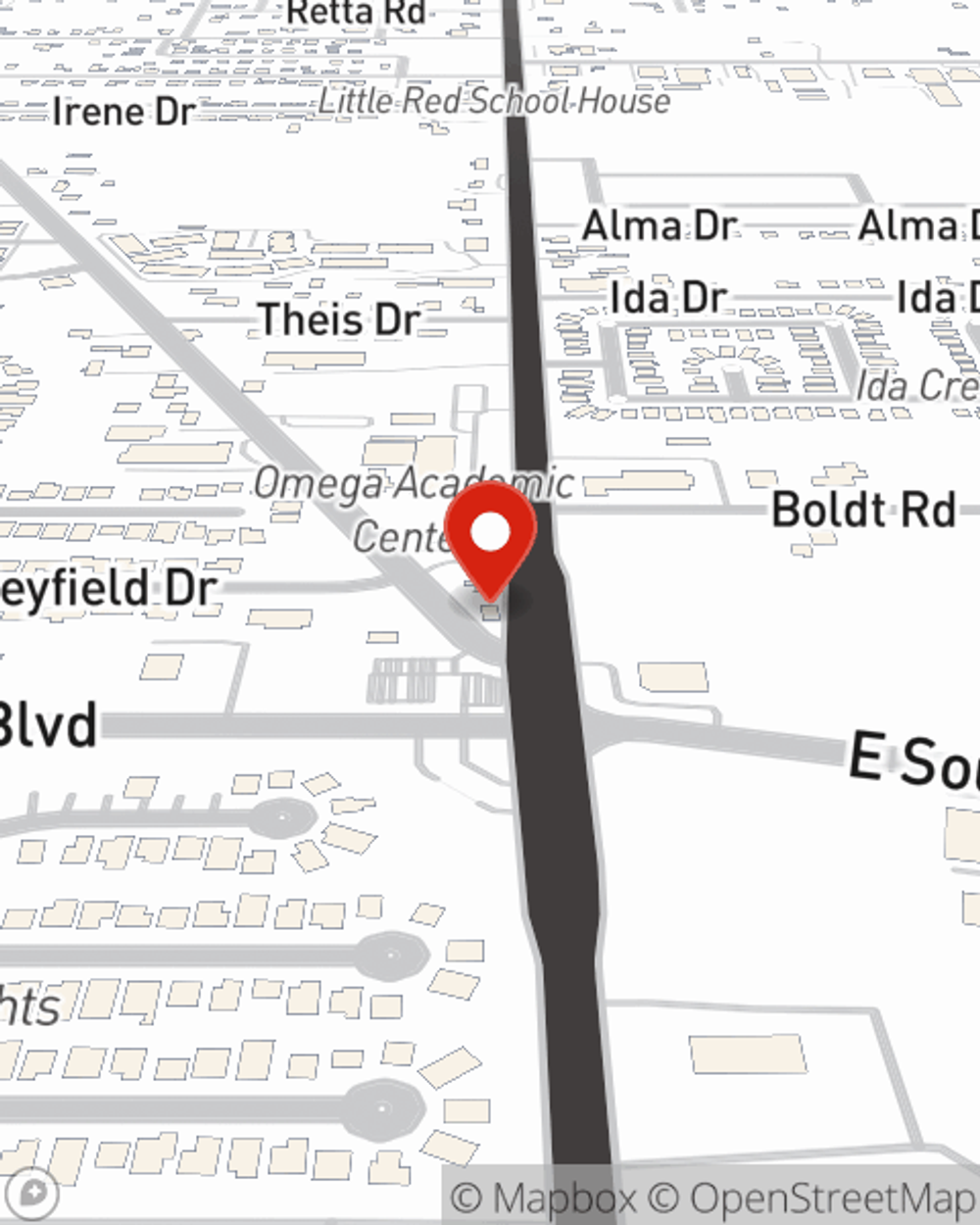

Aaron Furlong

State Farm® Insurance AgentSimple Insights®

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.